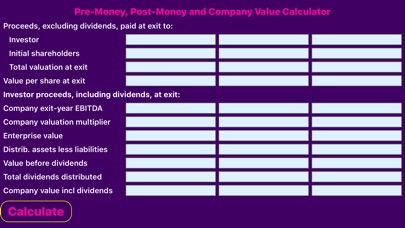

Company Valuation Calculator

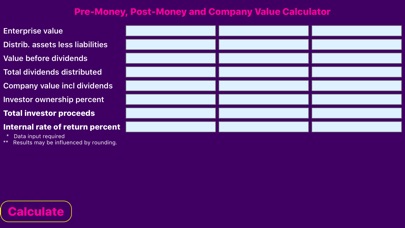

An educational experience for sophisticated users, CoValue, the Company Valuation Calculator, compares an investors equity infusion, ownership demands and pre-money capital stock purchase offers to company counter offers. Employing an exit-year strategy, financial data, such as Earnings before interest, taxes, depreciation and amortization (EBITDA), is extended by the generally recognized multiple of earnings method to arrive at an exit year enterprise value for the company. Enterprise value is then adjusted for dividends received over the investment period, assets not included in the exit year transaction (such as investments) and current and long term liabilities that must be satisfied upon exit, to arrive at adjusted net proceeds. The investors internal rate of return (irr) is then calculated by comparing the net proceeds available upon exit to the original investment. The investors net present value is also calculated to determine investment feasibility based upon the investors cost of capital.

The Company Valuation Calculator also provides a quick and easy method to perform sensitivity analyses for various levels of investments and ownership percentages. A comma separated value (.csv) file can be emailed from the app for reference and to perform additional spreadsheet analysis.